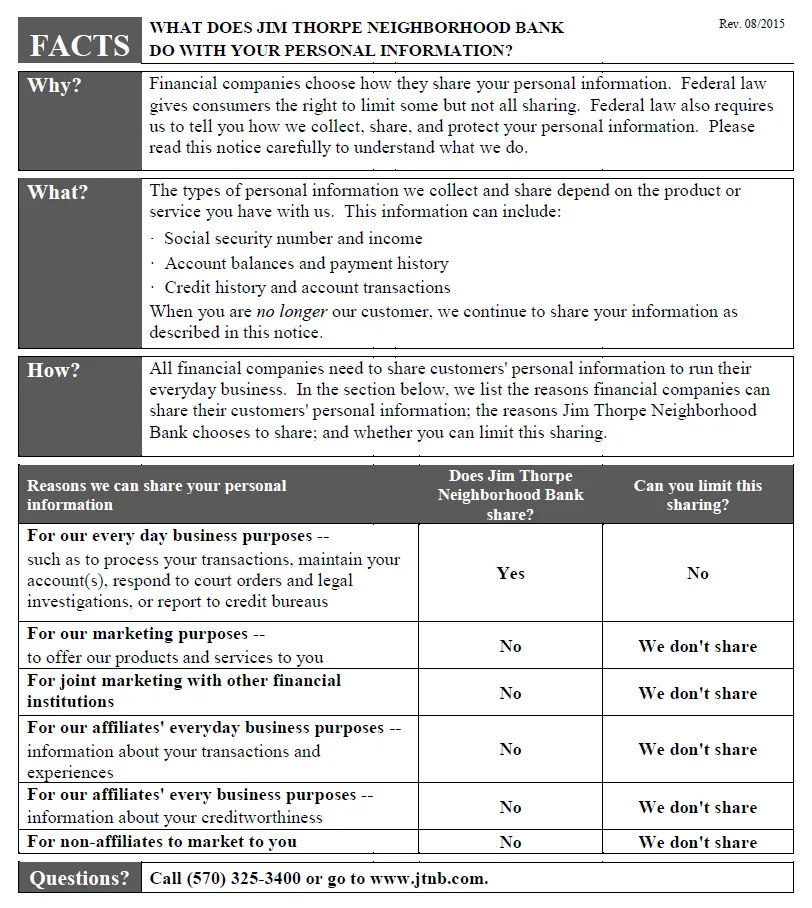

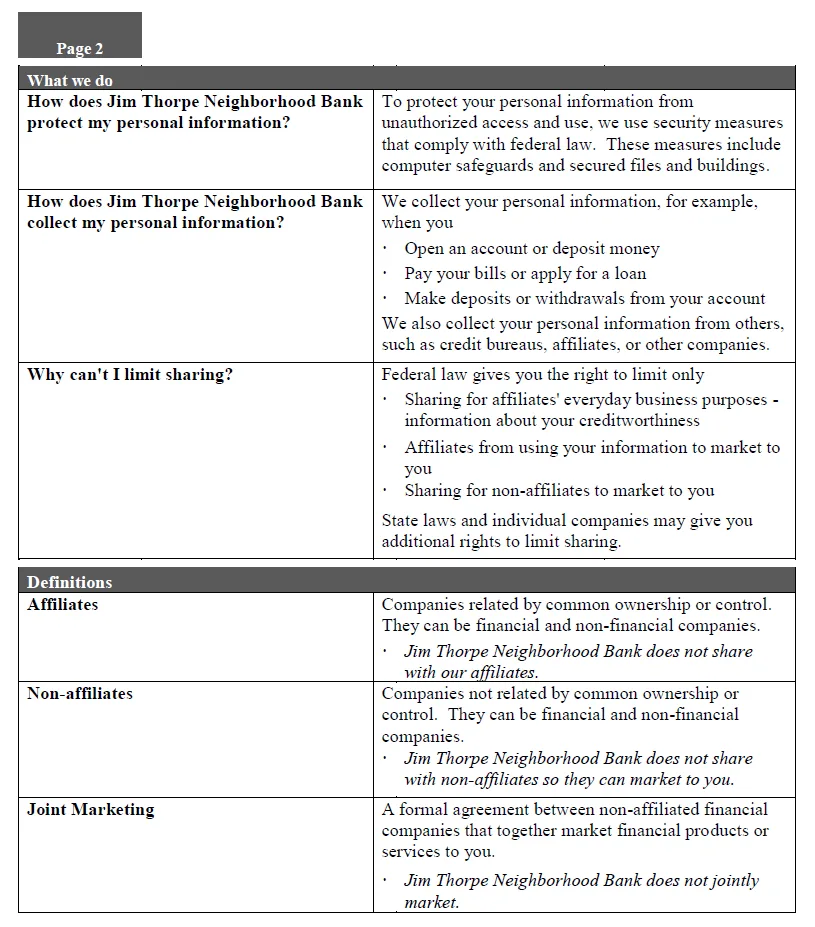

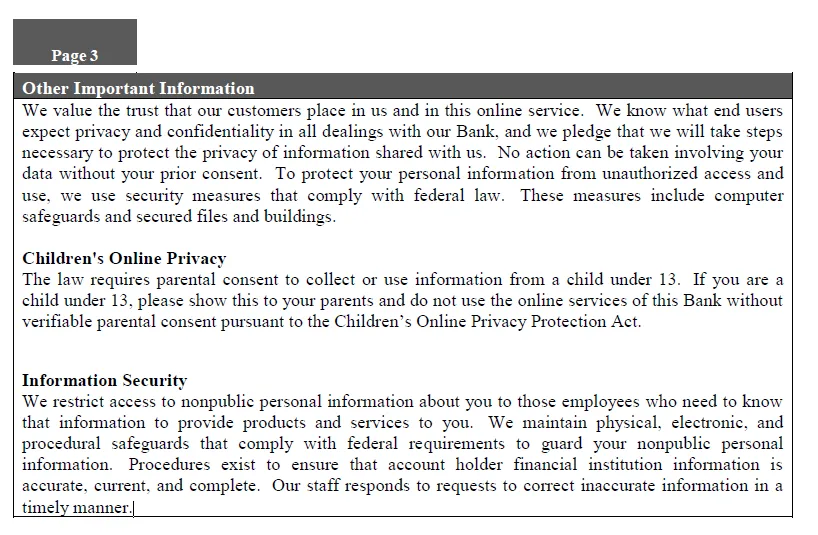

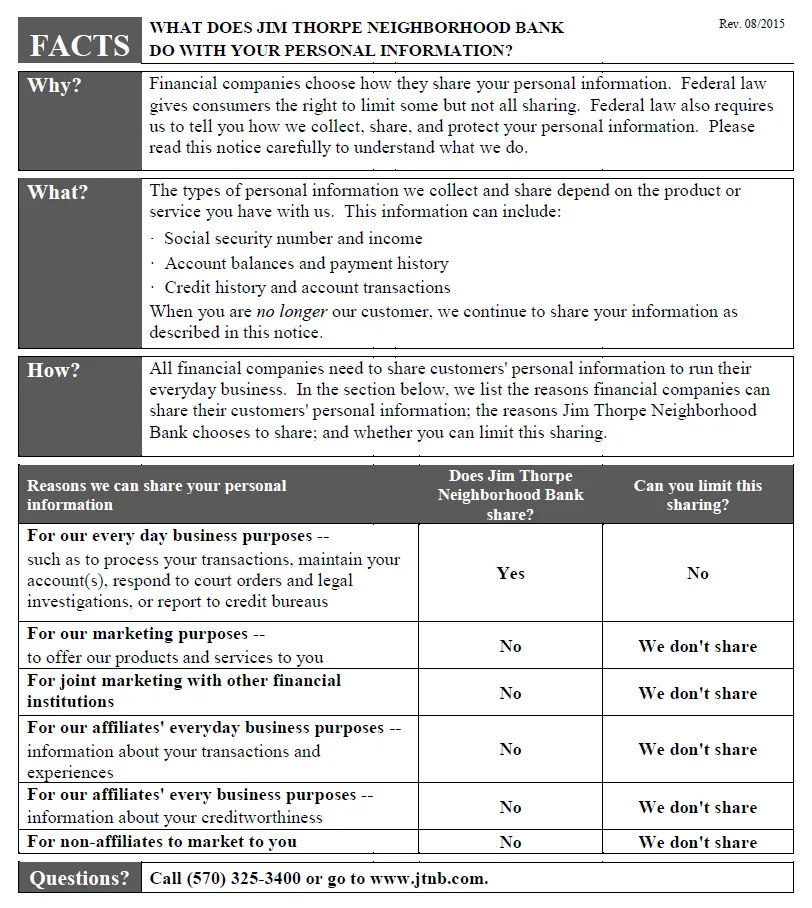

What does Jim Thorpe Neighborhood Bank do with your personal information?

View or Download our Privacy Policy

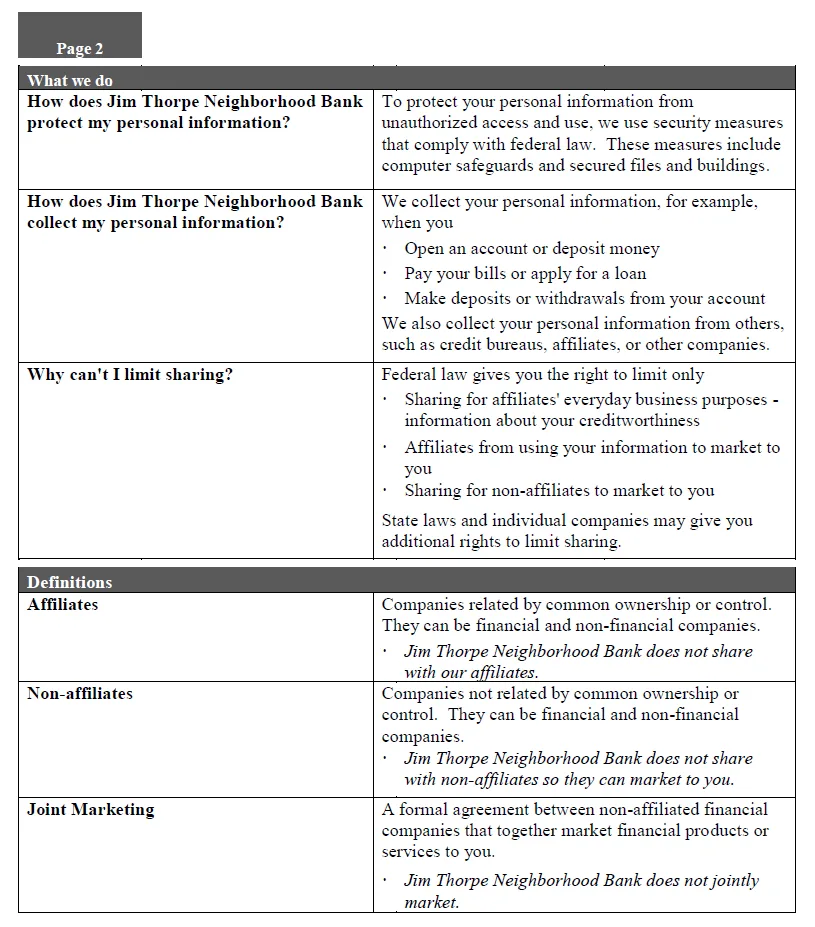

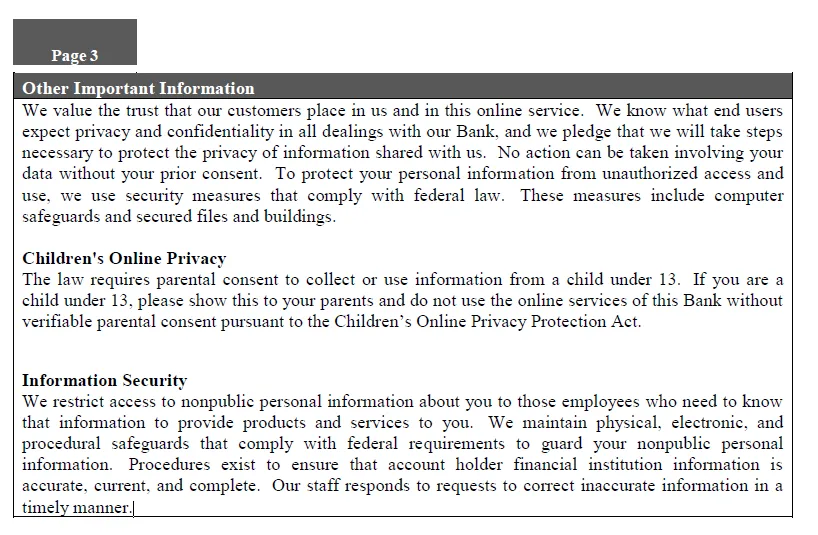

What does Jim Thorpe Neighborhood Bank do with your personal information?

View or Download our Privacy Policy

Jim Thorpe Neighborhood Bank has no control over information at any site hyperlinked to or from this Site. Jim Thorpe Neighborhood Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Jim Thorpe Neighborhood Bank of any information in any hyperlinked site. In no event shall Jim Thorpe Neighborhood Bank be responsible for your use of a hyperlinked site.

Some browser pop-up blockers will prevent the new window from opening. Please disable your pop-up blocker before clicking.